How Bitcoin Enables Financial Inclusion

Financial inclusion is the process of ensuring that individuals and businesses, regardless of their economic standing, have access to useful and affordable financial products and services. It includes everything from payments, credit, savings, and insurance. Yet, for many people worldwide, access to traditional financial services remains limited. This is where Bitcoin, the decentralized digital currency, has the potential to transform the financial landscape, opening up opportunities for billions of unbanked and underbanked individuals globally.

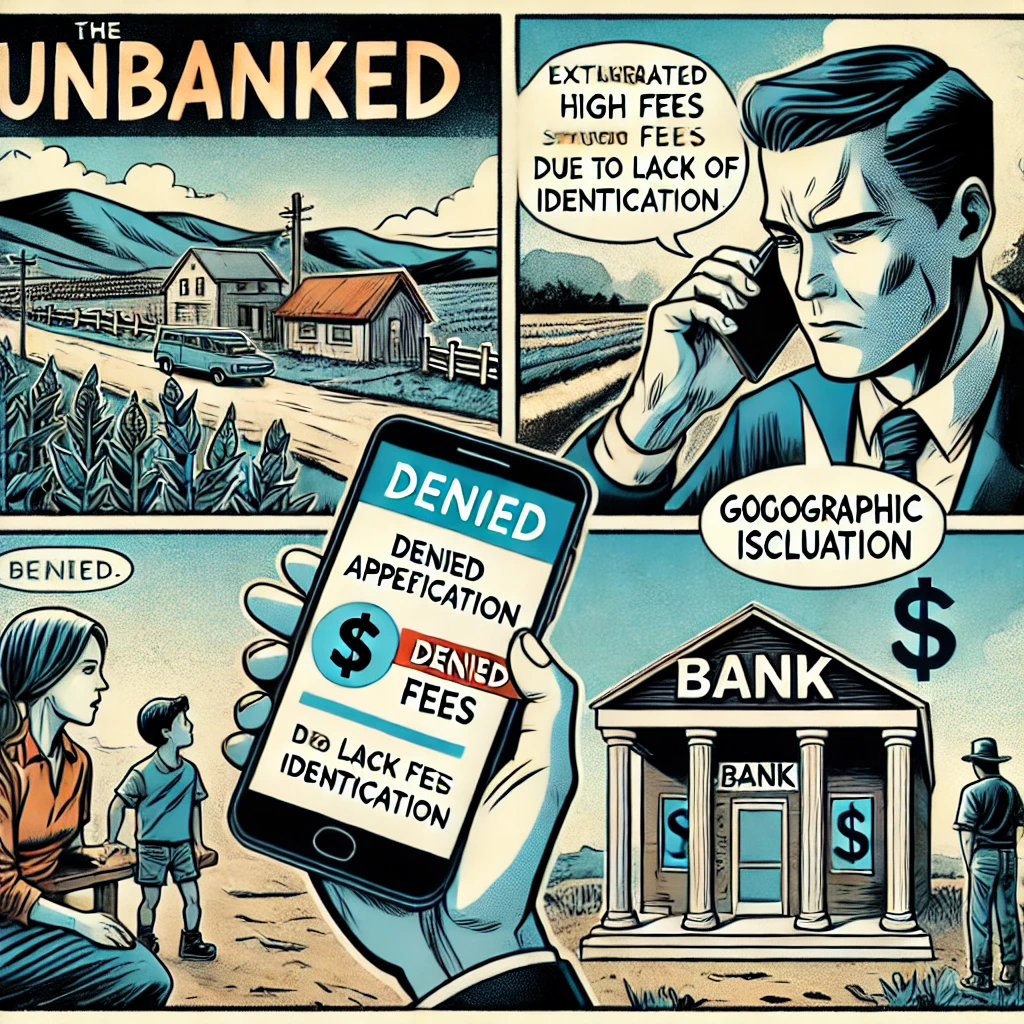

The Unbanked Problem

According to the World Bank, approximately 1.4 billion people worldwide do not have access to a bank account. Many more have limited access to financial services, often due to factors like:

- Geographic limitations: People in rural or remote areas may not have physical access to banks.

- Lack of proper documentation: Many individuals are excluded from banking systems due to the lack of identity verification.

- High fees: Traditional banking services often impose significant fees, especially for cross-border transactions and remittances, making them inaccessible to lower-income populations.

- Economic instability: Countries with unstable currencies or economies make traditional banking and saving less viable.

For these reasons, the conventional financial system often excludes a large portion of the population. Bitcoin, however, offers a new approach.

Bitcoin’s Role in Financial Inclusion

Bitcoin provides an alternative form of money that is decentralized, borderless, and permissionless. Let’s look at how Bitcoin can enable financial inclusion:

1. Borderless and Accessible

Bitcoin operates on a decentralized network, meaning no central authority controls its issuance or transaction approval. Anyone with a smartphone or a computer and internet access can participate in the Bitcoin economy, making it an ideal solution for people in regions where traditional banking infrastructure is limited or nonexistent.

Unlike banks, which require identification, minimum balances, and extensive paperwork, Bitcoin allows individuals to create a wallet with minimal technical knowledge and no identity verification. This makes it accessible to populations that cannot meet the stringent requirements of banks.

2. Reduced Transaction Costs

Traditional banking systems and remittance services often charge high fees for transferring money, especially across borders. For example, sending remittances to developing countries can cost an average of 6-7% of the amount being transferred. Bitcoin transactions, on the other hand, can be executed at a fraction of the cost, offering a more affordable way for individuals to send and receive money globally.

By reducing these transaction costs, Bitcoin enables people to retain more of their earnings and remittances, fostering economic growth and reducing the poverty cycle.

3. Security and Transparency

For those living in politically unstable regions or countries with weak financial institutions, safeguarding their money can be a significant concern. In such cases, traditional banking institutions might be subject to collapse, corruption, or devaluation of the national currency.

Bitcoin’s blockchain ensures transparency and security. Once a transaction is verified and recorded on the blockchain, it becomes immutable and verifiable by anyone. This trustless system provides individuals with control over their assets without relying on intermediaries who may be compromised by political or economic instability.

4. Financial Empowerment for the Unbanked

Bitcoin provides an opportunity for unbanked and underbanked populations to participate in the global economy. With Bitcoin, these individuals can:

- Save in a deflationary currency that is free from government manipulation, giving them a way to store and protect wealth.

- Transact globally without the need for intermediaries or foreign exchange fees.

- Access digital financial services such as lending, investment, and insurance products being developed in the decentralized finance (DeFi) space.

This level of empowerment, which is unavailable through traditional financial channels, gives people more economic autonomy and the ability to make decisions that can improve their livelihoods.

5. Empowering Entrepreneurs

In many developing countries, access to capital is one of the biggest hurdles for entrepreneurs and small businesses. Traditional financial institutions require credit histories, collateral, and a relationship with the banking system—all of which are barriers for many would-be entrepreneurs.

Bitcoin, along with other cryptocurrencies and blockchain-based platforms, enables entrepreneurs to raise capital through new, innovative methods like tokenization, crowdfunding, and peer-to-peer lending. This opens up a wide array of opportunities for people in underbanked regions to build businesses, stimulate local economies, and create jobs.

Challenges to Overcome

While Bitcoin has immense potential to enable financial inclusion, challenges still exist:

- Education: Many people in regions that could benefit the most from Bitcoin are unaware of its existence or do not have the technical knowledge to use it.

- Regulatory Hurdles: Some governments view Bitcoin as a threat to their control over the monetary system and have imposed restrictions or outright bans on its use.

- Volatility: Bitcoin's price volatility can make it difficult for individuals to adopt it as a stable form of savings or payment.

Conclusion

Bitcoin offers a new financial system that is open to anyone, anywhere in the world. By eliminating many of the barriers inherent in the traditional banking system, Bitcoin can empower billions of unbanked and underbanked individuals, helping them access financial services, build wealth, and participate in the global economy. While there are hurdles to overcome, the promise of Bitcoin as a force for financial inclusion is undeniable, offering hope for a more inclusive financial future.