The Convergence of AI and Bitcoin: A New Economic Paradigm

The Shift from Linear to Exponential

The industrial economy operated on linear principles - predictable cycles, clear relationships between inputs and outputs, and established valuation metrics. However, since the introduction of the iPhone in 2007 and Bitcoin in 2008, we've entered an era of exponential change that has rendered many traditional economic models obsolete.

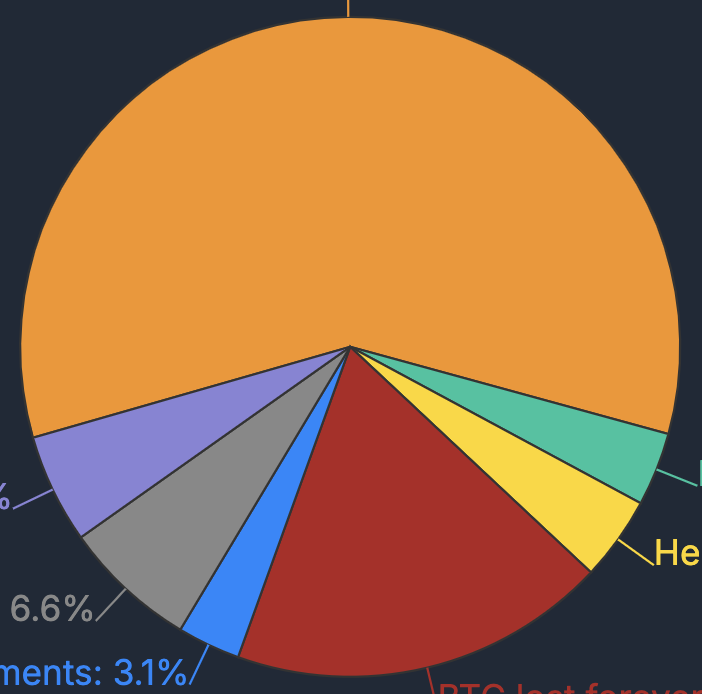

To illustrate this transformation, consider these pivotal changes since 2008:

- U.S. national debt grew from $7 trillion to $36 trillion

- Federal Reserve's balance sheet expanded from $1 trillion to $7 trillion

- The U.S. transformed from the largest oil importer to the largest exporter

- Mobile technology revolutionized how we interact with digital services

The Mag 7 Phenomenon and AI's Impact

The "Magnificent Seven" tech companies (Mag 7) represent a new type of business that defies traditional economic thinking. These companies showcase several unprecedented characteristics:

- Cash-Rich Operations: Unlike historical corporate giants, they operate with minimal debt relative to their cash positions

- Efficiency at Scale: They continue growing revenue while maintaining flat or declining employee headcounts

- Technology Advantage: Their massive investments in AI infrastructure create substantial competitive moats

- Global Reach: They operate more like sovereign entities than traditional corporations, with over 50% of revenues coming from outside their home markets

However, Visser suggests we're approaching an inflection point where even these dominant companies may face disruption from AI-driven innovation and the rise of Bitcoin.

The Path to Abundance

A crucial shift is occurring in our economic framework - from scarcity to abundance. Traditional economics was built on managing scarce resources, but technological advancement is pushing us toward a world where:

- AI can dramatically reduce the cost of producing goods and services

- 3D printing and other technologies could democratize manufacturing

- The cost of many services may trend toward zero

- Value will increasingly accrue to unique forms of digital property

The Energy Challenge

One significant concern Visser raises is the growing energy demands of our digital infrastructure. As AI capabilities expand, the power requirements for computation are increasing exponentially. This is evidenced by:

- Major tech companies securing nuclear power plants

- Goldman Sachs forecasting parabolic energy needs for AI

- Projects like Tesla's Dojo pushing the boundaries of computational power

Investment Implications

The investment landscape is shifting from a "batting average" approach to a "slugging percentage" mentality. This means:

- Concentrated Bets: Focus on asymmetric opportunities rather than diversification

- Early Stage Focus: The only strategy that might remain consistently effective is early-stage investing in strong founders

- Bitcoin Allocation: As traditional assets face technological deflation, Bitcoin offers a unique store of value

- AI Infrastructure: Companies enabling AI development could see continued strong growth

Looking Forward

The world is transitioning from an industrial economy based on scarcity to a digital economy characterized by abundance. In this new landscape, understanding the intersection of AI and Bitcoin isn't just about identifying investment opportunities - it's about comprehending the fundamental restructuring of how value is created, stored, and transferred in the digital age.